In case you were wondering: yes, this code has been updated so that it’s compatible with the iOS APIs that came after the XCode 6 beta period.

Here’s a fun programming exercise that you might want to try if you’ve been meaning to learn both Swift and game development for iOS: building a simple “shoot ’em” game using both!

This game features alien slugs (pictured on the left) that appear at random “altitudes” onscreen and travel from left to right or right to left, right in the line of fire of your ship, located near the bottom of the screen at the center. The player shoots at them by tapping on the screen; the locations of the player’s taps determine the direction of the shots.

This game features alien slugs (pictured on the left) that appear at random “altitudes” onscreen and travel from left to right or right to left, right in the line of fire of your ship, located near the bottom of the screen at the center. The player shoots at them by tapping on the screen; the locations of the player’s taps determine the direction of the shots.

As I said, it’s a simple game, but it introduces a fair number of concepts including:

- Drawing, positioning, scaling and moving sprites with Sprite Kit

- Operator overloading and extensions in Swift

- Vector math

- Responding to user taps

- Figuring out when two sprites collide

- Playing sound effects and a continuous soundtrack

I thought I’d do things “backwards” with this article series by giving you what you need to complete the project first, and then exploring the code section by section in subsequent articles. That way, you can immediately see what the final result should look like and do some experimenting and exploring on your own.

How to build the simple shoot ’em up game

- Create a new iOS project in Xcode based on the Game template. Give the project any name you like; I named mine SimpleShootEmUp.

- Make sure the app uses landscape orientation only by selecting your the project and target in the Project Navigator, and then in the Deployment section, make sure that Portrait is unchecked and Landscape Left and Landscape Right are checked.

- Download the .zip file of resources for the game, then unzip it. There’ll be two folders, Images.atlas and Sounds, which you should drag into your project. A dialog box will appear; make sure that Copy items into destination group’s folder (if needed) is checked, and that your project’s target is selected.

- And finally, replace the contents of the GameScene.swift file that was automatically generated for your project with the code below. I’ve commented it rather heavily to help you get a better idea of what’s going on:

//

// GameScene.swift

// SpriteKitTutorial1

//

// Written by Joey deVilla - August 2014

// Last updated September 30, 2014

// using XCode 6.0.1

//

// A simple shoot-em-up game that shows some Sprite Kit basics in Swift.

// Some of the code was adapted from the simple game featured in

// Ray Wenderlich's article, "Sprite Kit Tutorial for Beginners"

// at RayWenderlich.com

// (http://www.raywenderlich.com/42699/spritekit-tutorial-for-beginners).

import SpriteKit

import AVFoundation

// MARK: - Vector math operators and CGPoint extensions

// ====================================================

// In this app, we're using CGPoints to do some vector math (yes, there's a CGVector type,

// but in this case, it's just more convenient to use CGPoints to represent both vectors

// and points).

//

// I've marked these as private to limit the scope of these overloads and extensions

// to this file.

// Vector addition

private func + (left: CGPoint, right: CGPoint) -> CGPoint {

return CGPoint(x: left.x + right.x, y: left.y + right.y)

}

// Vector subtraction

private func -(left: CGPoint, right: CGPoint) -> CGPoint {

return CGPoint(x: left.x - right.x, y: left.y - right.y)

}

// Vector * scalar

private func *(point: CGPoint, factor: CGFloat) -> CGPoint {

return CGPoint(x: point.x * factor, y:point.y * factor)

}

private extension CGPoint {

// Get the length (a.k.a. magnitude) of the vector

var length: CGFloat { return sqrt(self.x * self.x + self.y * self.y) }

// Normalize the vector (preserve its direction, but change its magnitude to 1)

var normalized: CGPoint { return CGPoint(x: self.x / self.length, y: self.y / self.length) }

}

// MARK: -

class GameScene: SKScene, SKPhysicsContactDelegate {

// MARK: Properties

// ================

// Background music

// ----------------

private var backgroundMusicPlayer: AVAudioPlayer!

// Game time trackers

// ------------------

private var lastUpdateTime: CFTimeInterval = 0 // Time when update() was last called

private var timeSinceLastAlienSpawned: CFTimeInterval = 0 // Seconds since the last alien was spawned

// Ship sprite

// -----------

// For simplicity's sake, we'll use the spaceship that's provided in Images.xcassets

// when you start a new Game project

private let ship = SKSpriteNode(imageNamed: "Spaceship")

// Physics body category bitmasks

// ------------------------------

// We'll use these to determine missle-alien collisions

private let missileCategory: UInt32 = 0x1 << 0 // 00000000000000000000000000000001 in binary

private let alienCategory: UInt32 = 0x1 << 1 // 00000000000000000000000000000010 in binary

// MARK: Events

// ============

// Called immediately after the view presents this scene.

override func didMoveToView(view: SKView) {

// Start the background music player

var error: NSError?

let backgroundMusicURL = NSBundle.mainBundle().URLForResource("background-music", withExtension: "aiff")

backgroundMusicPlayer = AVAudioPlayer(contentsOfURL: backgroundMusicURL, error: &error)

backgroundMusicPlayer.numberOfLoops = -1

backgroundMusicPlayer.prepareToPlay()

backgroundMusicPlayer.play()

// Set the game's background color to white

backgroundColor = SKColor(red: 1, green: 1, blue: 1, alpha: 1)

// Position the player's ship halfway across the screen,

// near the bottom

ship.setScale(0.25)

ship.position = CGPoint(x: size.width / 2, y: ship.size.height * 1.25)

addChild(ship)

// Game physics

physicsWorld.gravity = CGVector(0, 0) // No gravity in this game...yet!

physicsWorld.contactDelegate = self // We'll handle contact between physics bodies in this class

spawnAlien() // Start the game with a single alien

}

// Called exactly once per frame as long as the scene is presented in a view

// and isn't paused

override func update(currentTime: CFTimeInterval) {

var timeSinceLastUpdate = currentTime - lastUpdateTime

lastUpdateTime = currentTime

if timeSinceLastUpdate > 1 {

timeSinceLastUpdate = 1.0 / 60.0

lastUpdateTime = currentTime

}

updateWithTimeSinceLastUpdate(timeSinceLastUpdate)

}

// Called whenever the user touches the screen

override func touchesEnded(touches: NSSet, withEvent event: UIEvent) {

// Select one of the user's touches. Given the event loop's speed, there aren't likely

// to be more than 1 or 2 touches in the set.

let touch = touches.anyObject() as UITouch

let touchLocation = touch.locationInNode(self)

// Reject any shots that are below the ship, or directly to the right or left

let targetingVector = touchLocation - ship.position

if targetingVector.y > 0 {

// FIRE ZE MISSILES!!!

fireMissile(targetingVector)

}

}

// SKPhysicsContactDelegate method: called whenever two physics bodies

// first contact each other

func didBeginContact(contact: SKPhysicsContact!) {

var firstBody: SKPhysicsBody!

var secondBody: SKPhysicsBody!

// An SKPhysicsContact object is created when 2 physics bodies make contact,

// and those bodies are referenced by its bodyA and bodyB properties.

// We want to sort these bodies by their bitmasks so that it's easier

// to identify which body belongs to which sprite.

if contact.bodyA.categoryBitMask < contact.bodyB.categoryBitMask {

firstBody = contact.bodyA

secondBody = contact.bodyB

}

else {

firstBody = contact.bodyB

secondBody = contact.bodyA

}

// We only care about missile-alien contacts.

// If the contact is missile-alien, firstBody refers to the missile's physics body,

// and second body refers to the alien's physics body.

if (firstBody.categoryBitMask & missileCategory) != 0 &&

(secondBody.categoryBitMask & alienCategory) != 0 {

destroyAlien(firstBody.node as SKSpriteNode, alien: secondBody.node as SKSpriteNode)

}

}

// MARK: Game state

// ================

func updateWithTimeSinceLastUpdate(timeSinceLastUpdate: CFTimeInterval) {

// If it's been more than a second since we spawned the last alien,

// spawn a new one

timeSinceLastAlienSpawned += timeSinceLastUpdate

if (timeSinceLastAlienSpawned > 0.5) {

timeSinceLastAlienSpawned = 0

spawnAlien()

}

}

func spawnAlien() {

enum Direction {

case GoingRight

case GoingLeft

}

var alienDirection: Direction!

var alienSpriteImage: String!

// Randomly pick the alien's origin

if Int(arc4random_uniform(2)) == 0 {

alienDirection = Direction.GoingRight

alienSpriteImage = "alien-going-right"

}

else {

alienDirection = Direction.GoingLeft

alienSpriteImage = "alien-going-left"

}

// Create the alien sprite

let alien = SKSpriteNode(imageNamed: alienSpriteImage)

// Give the alien sprite a physics body

alien.physicsBody = SKPhysicsBody(rectangleOfSize: alien.size)

alien.physicsBody?.dynamic = true

alien.physicsBody?.categoryBitMask = alienCategory

alien.physicsBody?.contactTestBitMask = missileCategory

alien.physicsBody?.collisionBitMask = 0

// Set the alien's initial coordinates

var alienSpawnX: CGFloat!

var alienEndX: CGFloat!

if alienDirection == Direction.GoingRight {

alienSpawnX = -(alien.size.width / 2)

alienEndX = frame.size.width + (alien.size.width / 2)

}

else {

alienSpawnX = frame.size.width + (alien.size.width / 2)

alienEndX = -(alien.size.width / 2)

}

let minSpawnY = frame.size.height / 3

let maxSpawnY = (frame.size.height * 0.9) - alien.size.height / 2

let spawnYRange = UInt32(maxSpawnY - minSpawnY)

let alienSpawnY = CGFloat(arc4random_uniform(spawnYRange)) + minSpawnY

alien.position = CGPoint(x: alienSpawnX, y: alienSpawnY)

// Put the alien onscreen

addChild(alien)

// Set the alien's speed

let minMoveTime = 2

let maxMoveTime = 4

let moveTimeRange = maxMoveTime - minMoveTime

let moveTime = NSTimeInterval((Int(arc4random_uniform(UInt32(moveTimeRange))) + minMoveTime))

// Send the alien on its way

let moveAction = SKAction.moveToX(alienEndX, duration: moveTime)

let cleanUpAction = SKAction.removeFromParent()

alien.runAction(SKAction.sequence([moveAction, cleanUpAction]))

}

func fireMissile(targetingVector: CGPoint) {

// Now that we've confirmed that the shot is "legal", FIRE ZE MISSILES!

// Play shooting sound

runAction(SKAction.playSoundFileNamed("missile.mp3", waitForCompletion: false))

// Create the missile sprite at the ship's location

let missile = SKSpriteNode(imageNamed: "missile")

missile.position.x = ship.position.x

missile.position.y = ship.position.y + (ship.size.height / 2)

// Give the missile sprite a physics body

missile.physicsBody = SKPhysicsBody(circleOfRadius: missile.size.width / 2)

missile.physicsBody?.dynamic = true

missile.physicsBody?.categoryBitMask = missileCategory

missile.physicsBody?.contactTestBitMask = alienCategory

missile.physicsBody?.collisionBitMask = 0

missile.physicsBody?.usesPreciseCollisionDetection = true

addChild(missile)

// Calculate the missile's speed and final destination

let direction = targetingVector.normalized

let missileVector = direction * 1000

let missileEndPos = missileVector + missile.position

let missileSpeed: CGFloat = 500

let missileMoveTime = size.width / missileSpeed

// Send the missile on its way

let actionMove = SKAction.moveTo(missileEndPos, duration: NSTimeInterval(missileMoveTime))

let actionMoveDone = SKAction.removeFromParent()

missile.runAction(SKAction.sequence([actionMove, actionMoveDone]))

}

func destroyAlien(missile: SKSpriteNode, alien: SKSpriteNode) {

// Play explosion sound

runAction(SKAction.playSoundFileNamed("explosion.wav", waitForCompletion: false))

// When a missile hits an alien, both disappear

missile.removeFromParent()

alien.removeFromParent()

}

}

Once that’s done, the game’s ready to run. Go ahead and run it, play, explore the code, experiment, and learn! In the next installment, I’ll start explaining the code, starting with some Sprite Kit basics.

Credit where credit is due

- Much of the code is a Swift adaptation of the code in Ray Wenderlich’s September 2013 article, Sprite Kit Tutorial for Beginners. If you’re serious about learning iOS development, you want to bookmark Ray’s site, RayWenderlich.com, the home of not just tutorial articles, but tutorial videos, very in-depth books, and even starter kits for budding iOS game developers.

- The alien images were taken from Backyard Ninja Design’s Free Stuff page, specifically the set of sprite from their “Crapmunch” game.

- The ship image is the one included in the example game that’s automatically created when you generate a game project.

- The background music is FU4, created by Partners in Rhyme, and can be found on their Free Royalty-Free Music Loops page.

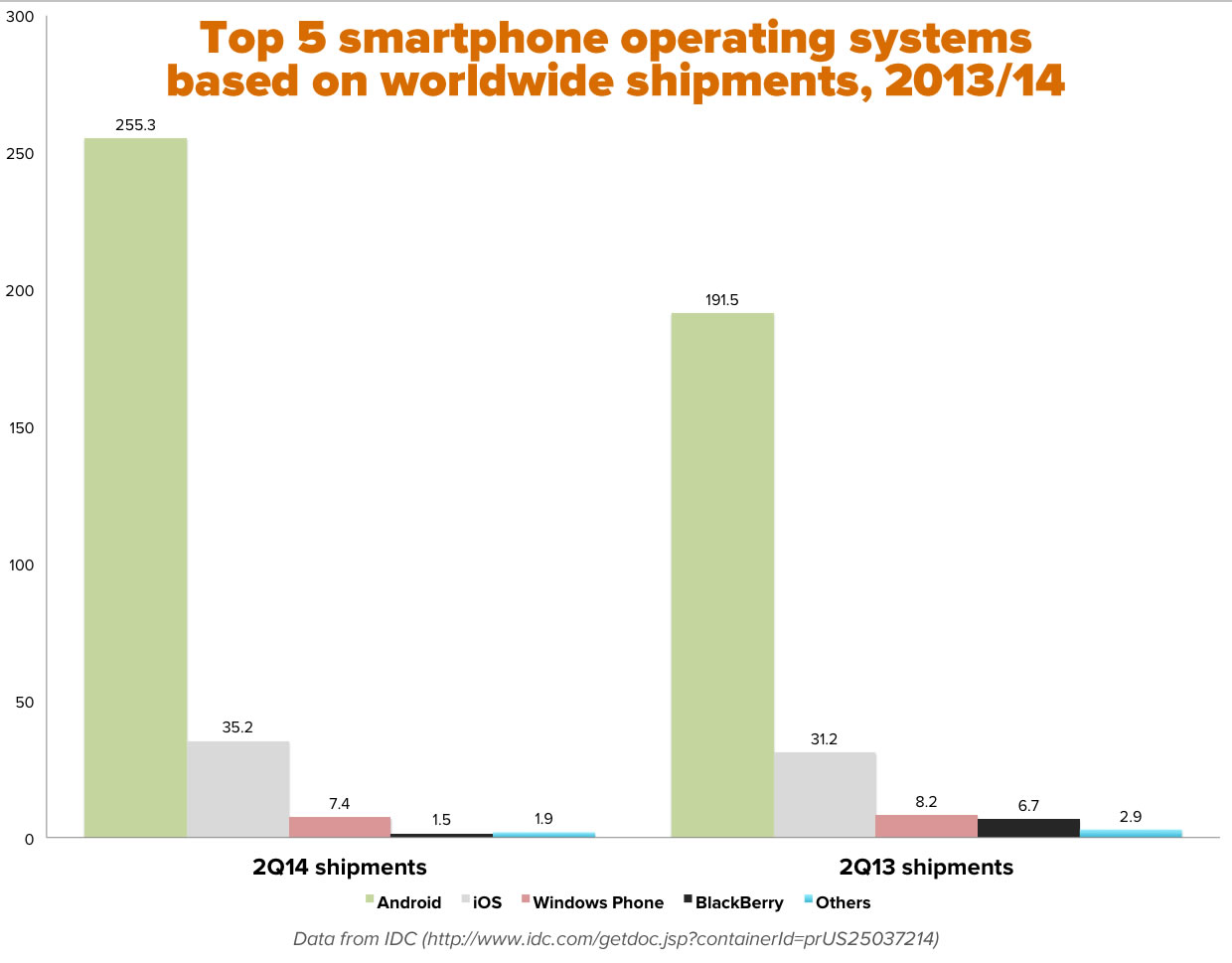

Based on IDC’s numbers, the combined share of Android and iOS is 96.4% this quarter, leaving the remaining players to fight over the remaining 5.6%. Android and iOS were the only mobile operating systems to see year-over-year growth this quarter, with Android shipments up 33%, and iOS shipments up nearly 13%. Every other OS vendor lost share between this year and last.

Based on IDC’s numbers, the combined share of Android and iOS is 96.4% this quarter, leaving the remaining players to fight over the remaining 5.6%. Android and iOS were the only mobile operating systems to see year-over-year growth this quarter, with Android shipments up 33%, and iOS shipments up nearly 13%. Every other OS vendor lost share between this year and last.