What Lenovo Gets

The rumors started earlier Wednesday afternoon, and they were confirmed in a Google press release a few hours later: Lenovo will acquire Motorola Mobility from Google for the sum of US$2.91 billion dollars.

This is Lenovo’s second purchase of a major American brand, the first one being the 2005 acquisition of IBM’s ThinkPad, along with the rest of IBM’s PC business. Lenovo played it smart and didn’t fix what wasn’t broken, namely the ThinkPad name as well as its look, which is descended from the original ThinkPad “bento box” design created by Richard Sapper in 1990. Lenovo founder Liu Chanzhi says that the three things that Lenovo got from the IBM acquisition were:

This is Lenovo’s second purchase of a major American brand, the first one being the 2005 acquisition of IBM’s ThinkPad, along with the rest of IBM’s PC business. Lenovo played it smart and didn’t fix what wasn’t broken, namely the ThinkPad name as well as its look, which is descended from the original ThinkPad “bento box” design created by Richard Sapper in 1990. Lenovo founder Liu Chanzhi says that the three things that Lenovo got from the IBM acquisition were:

- The Thinkpad brand

- More advanced PC manufacturing technology

- International resources, such as IBM’s global sales channels and operations teams

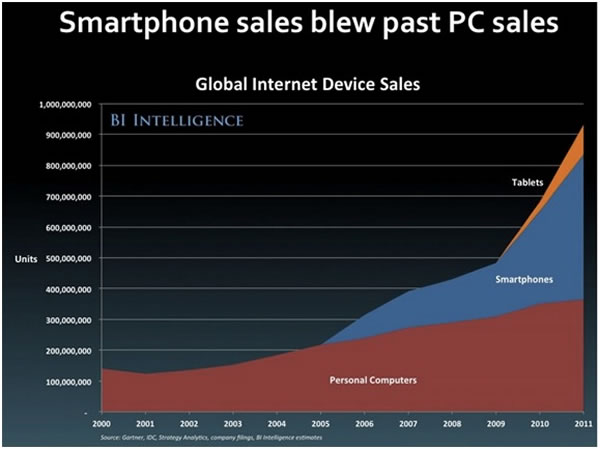

It seems to have worked; last year, Lenovo became the world’s biggest seller of PCs by unit sales, and it’s widening its lead over the nearest competitors, HP and Dell. That’s Lenovo’s blessing and curse: it’s now the leader in an industry that’s beginning to decline. You’ve probably seen all those charts that look something like this:

Lenovo’s plan appears to be to repeat their success with ThinkPad, and eventually beat Samsung. This time, Lenovo has the advanced manufacturing facility. In fact, they’re the 4th largest smartphone manufacturer in the world — even bigger than LG or HTC. Thanks to their success in the PC marketplace, they also have global sales channels and operations teams. The one thing they’re missing, and the one thing they’re apparently buying, is a brand that’s recognized in North America and Latin America. That’s why they were looking at BlackBerry — another respected brand that had fallen on bad times — but the possibility of a sale was supposedly killed by the Canadian government.

Bloomberg Technology quotes the head of Lenovo’s new mobile business group Liu Jun, who said this at the recent CES:

“The U.S. is the most important market in the smartphone space. From day one, when we targeted the smartphone business, we thought that to be a global player, we must win in the U.S.”

Motorola may not be getting the sales like the top two players here — Apple and Samsung — but they are in third place, and the name still has some weight, and that’s what Lenovo needs to get in the game here.

What Google Gets

Google’s taking a bit of a bath here. When they approached Motorola with an offer in 2011, they followed up by bumping it up by a third in a single day, even though Motorola wasn’t taking any competing bids. The agreed price was $12.5 billion.

Google’s taking a bit of a bath here. When they approached Motorola with an offer in 2011, they followed up by bumping it up by a third in a single day, even though Motorola wasn’t taking any competing bids. The agreed price was $12.5 billion.

“I bet it would take longer to literally flush $9.5 billion in cash down a toilet than it took for Google to do so figuratively on the Motorola acquisition,” wrote John Gruber in Daring Fireball. That flushing figure is probably closer to a mere $7.2 billion, as Ina Fried points out: Google made some money back by selling Motorola’s cable set-top box division in late 2012 for 2.35 billion.

Google gets to keep most of Motorola’s patent portfolio in the deal. The patents are a stick with which to beat money out of other companies without having to sell a single unit, but as Ina Fried observes:

Google has continued to assert Motorola’s substantial patent holdings in various cases, but courts and regulators have largely taken a dim view of issuing injunctions or large damage awards based on standards-essential patents — the patent variety that makes up a large part of Motorola’s holdings.

She also notes that by getting out of the mobile hardware business, Google is making nice with Android smartphone and tablet manufacturers, particularly Samsung. Google and the top Android smartphone vendor have come to a number of agreements, including a cross-licensing deal over past and future patents, and Samsung has promised to ease up on its own modifications to Android and stick to standard Google services and apps. It’s a signal to the mobile hardware folks that Google will stick to software and leave the hardware to its manufacturing partners, an arrangement similar to Microsoft and its hardware buddies — at least in the pre-Surface-the-tablet, pre-Nokia-purchase days.

Two notes:

- Google’s recent acquisition of Nest suggests that the “you do hardware, we’ll do software” arrangement applies only to mobile devices.

- I can’t help thinking of Jon Gruber’s snarky quote about this arrangement: “One of Alan Kay’s numerous oft-cited quotations is, ‘People who are really serious about software should partner with an OEM in Asia.’ No, wait, that’s not what he said. What he said is, ‘People who are really serious about software should make their own hardware.'”