It hasn’t even been a decade since the world of telecommunications got revolutionized by the convergence of the internet, mobile computing, and wireless. For the longest time, mobile carriers resisted the change, concerned that a world of smartphones and apps would disrupt their business models and networks. If you look at the numbers, they appear to have adapted quite handily.

A handful of years ago, mobile phones’ primary use was voice calls, and hence your voice minutes were the precious metered commodity and data (then largely used for texting) was unlimited. Smartphones — and more accurately, their apps — flipped that usage pattern, and mobile carriers flipped their billing model in response, offering unlimited voice calls and putting a meter on data.

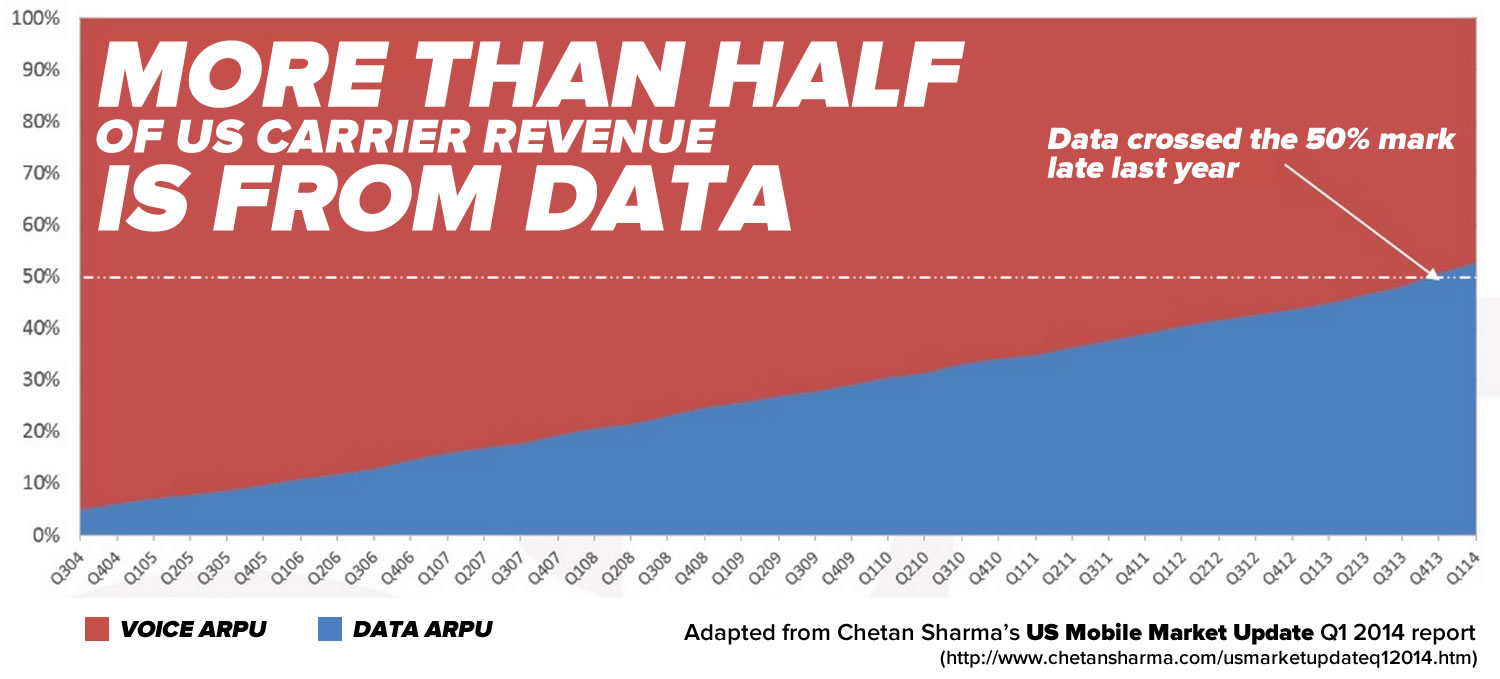

As technology consultant Chetan Sharma observed in his US Mobile Market Update Q1 2014 report, data’s share of carrier ARPU (average revenue per user) has been climbing steadily and now accounts for more than half their revenue:

Click the graph to see it at full size.

You may be surprised to note that the US was the seventh nation to hit the point where more than half of mobile carrier revenue comes from data. Japan, who’ve been using mobile phones for more than voice for far longer than we have, lead this category, with 70% of their carrier revenue generated from data.

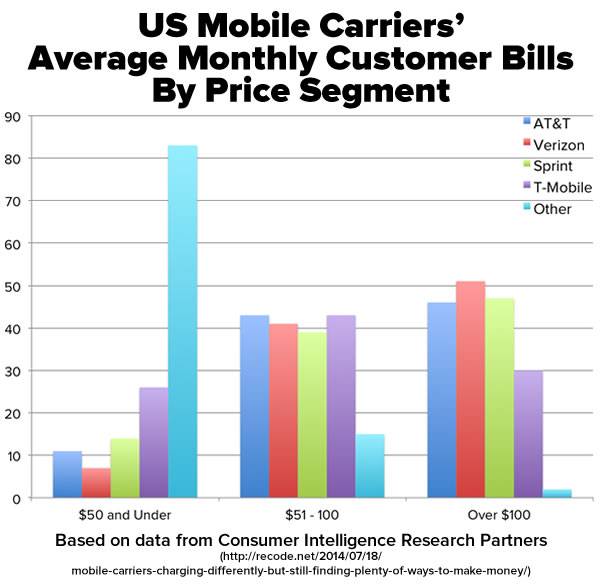

Re/code’s Ina Fried points to a recent Consumer Intelligence Research Partners (CIRP) report that says that of the big US carriers, Verizon made the most of this transition, with the fewest customers on an unlimited data plan, and the largest share of customers paying more than $100 a month. She included a table of CIRP’s data showing the US mobile carriers’ average monthly bill; we took that data and turned it into two graphs. The first divides the bills into three price segments:

- $50 and under/month

- Between $50 and $100/month

- Over $100/month

Click the graph to see the data source.

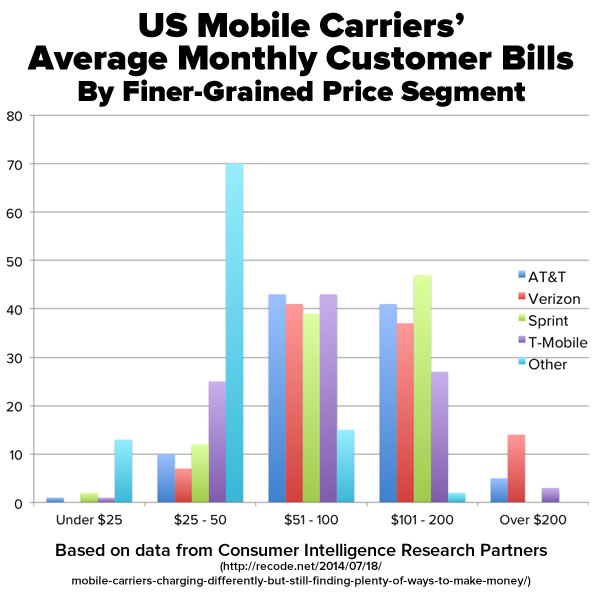

The second graph is a little more granular, with the following price segments:

- Under $25/month

- $25 – 50/month

- $51 – 100/month

- $101 – 200/month

- Over $200/month

Click the graph to see the data source.

Some observations based on the data:

- The smaller carriers live off the cheapest segment of the market, making over 80% of their mobile billing revenue from customers paying $50/month and less.

- The big 4 carriers — AT&T, Verizon, Sprint, and T-Mobile — make about 40% of their mobile billing revenue from customers paying between in the $51 – $100 range.

- The largest 3 carriers make most of their mobile billing revenue from customers who pay over $100/month.

- Verizon is making money off the high-rollers, with 15% of their mobile billing revenue coming from people who pay over $200/month.

Click the image to see the data source.

Chetan Sharma says that with US mobile services growing these ways in Q1 2014:

- 4% quarter over quarter, and

- 23% year over year,

…it’s expected that the US will become the first country to cross the $100 billion mark in mobile data service revenue, with continued growth expected as more businesses rely on mobile technology and services to generate revenue.

It’s good to be a mobile carrier.

3 replies on “In spite of all the changes in the mobile industry, the carriers are managing to make even more money”

[…] but in the end, the iPhone not only redefined what a smartphone was, but helped drive the convergence of mobile computing, wireless, and the internet, which in turn helped change the telecom industry’s business model from a voice-based one to a data-based one. […]

Thank you for the very interesting data. The usage of mobile phones rises every day, but the cost of talks is falling too. But it seems that it doesn’t stop revenue from rising

Oh, time was changed. Now people spend money on the internet, not a calls and I think wifi run the world. Now the operators are fighting for high-quality mobile internet and more users.