Internet analytics firm comScore recently released their data from their MobiLens and Mobile Metrix services, creating a snapshot of smartphone usage in the United States for October 2013. There’s nothing particularly surprising in this snapshot: the current numbers reflect the same general trends over the past year.

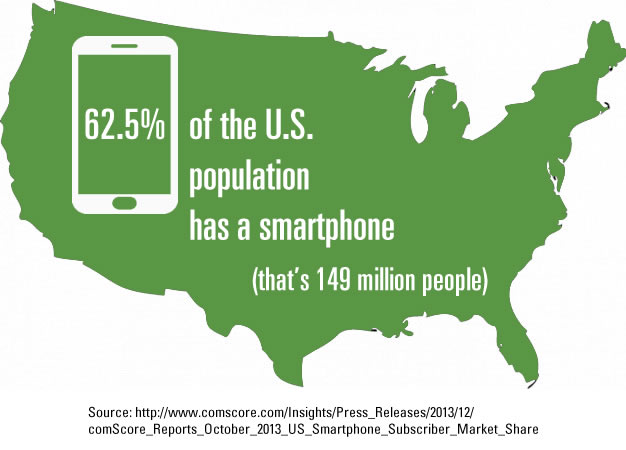

62% of the U.S. population has a smartphone

Click the picture to see the source data.

As of October 2013, there were 149 million smartphone users age 13 and older in the U.S., which accounts for 62.5% of the country’s population. This represents an increase of 4.1% over the previous snapshot, taken in July 2013. It’s very likely we’ll see smartphone users accounting for two-thirds of the population in early 2014.

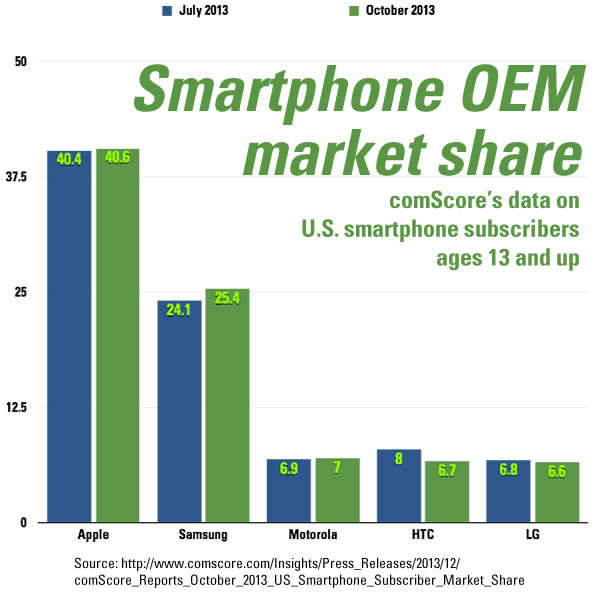

Apple is the leading smartphone OEM; Samsung has the fastest-growing share

Click the graph to see the source data.

In October 2013, Apple was the leading smartphone OEM, having captured 40.6% of U.S. smartphone subscribers age 13 and up, an increase of 0.2% since the July 2013 snapshot. Samsung is in second place, with 25.4% of the market (an increase of 1.3% since July 2013), followed by Motorola, HTC, and LG, each with about 7%.

The OEMs with the biggest changes in market share were Samsung, who showed a gain of 1.3% since July 2013, and HTC, who showed an equal percentage loss in the same time period.

Top smartphone OEMs

3-month average ending October 2013 vs. 3-month average ending July 2013

Source: comScore MobiLens

| Vendor | Jul 2013 | Oct 2013 | Change |

|---|---|---|---|

| Apple | 40.4% | 40.6% | 0.2% |

| Samsung | 24.1% | 25.4% | 1.3% |

| Motorola | 6.9% | 7.0% | 0.1% |

| HTC | 8.0% | 6.7% | -1.3% |

| LG | 6.8% | 6.6% | -0.2% |

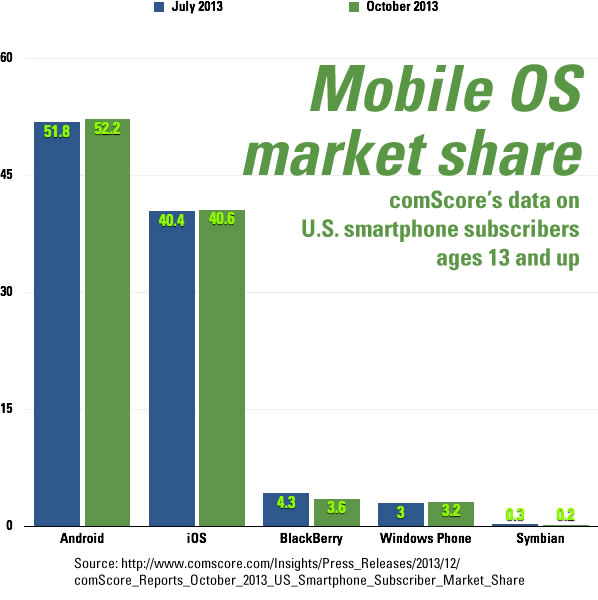

Android and iOS combined maintain over 90% of the mobile platform market

Click the graph to see the source data.

Android was the leading platform in October 2013, with 52.2% of the market (an increase of 0.4% over the July 2013 snapshot), followed by iOS at 40.6% (an increase of 0.2%). BlackBerry and Windows Phone are still fighting for distant third place at 3.6% and 3.2% respectively, with BlackBerry’s share having fallen 0.7% and Windows Phone’s having risen 0.2%. The Symbian market share continues its decline to zero, having dropped from 0.3% to 0.2% from July to October 2013.

With all the bad news about BlackBerry, including the oral history published in this week’s Bloomberg Businessweek and the recommendations from analysts like Gartner to abandon the BlackBerry platform, we should expect Windows Phone to take the lead in the race for distant third place when the next comScore snapshot comes out.

Top smartphone platforms

3-month average ending October 2013 vs. 3-month average ending July 2013

Source: comScore MobiLens

| Platform | Jul 2013 | Oct 2013 | Change |

|---|---|---|---|

| Android | 51.8% | 52.2% | 0.4% |

| iOS | 40.4% | 40.6% | 0.2% |

| BlackBerry | 4.3% | 3.6% | -0.7% |

| Windows Phone | 3.0% | 3.2% | 0.2% |

| Symbian | 0.3% | 0.2% | -0.1% |

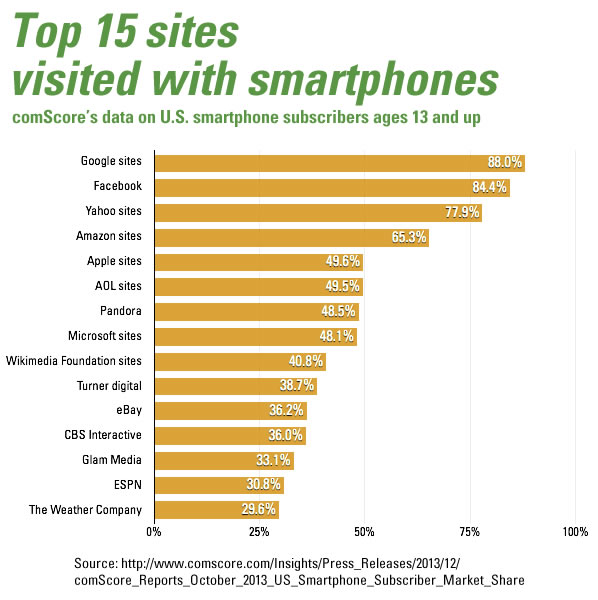

The big players have the top sites for mobile visitors

Click the graph to see the source data.

These figures shouldn’t be surprising: the sites that act as portals to a vast field of information, whether search, news, shopping, or social contacts were the top sites visited using smartphones in October 2013. Nearly 9 out of 10 smartphone users access Google’s and Facebook’s sites, nearly 8 out of 10 visited a Yahoo! sites, nearly two-thirds visited Amazon, and about half visited Apple.

In case you were wondering:

- Turner Digital includes CNN.com, NBA.com, Yahoo! Sports NBA and Yahoo! Sports NASCAR, CartoonNetwork.com as well as Funny or Die and The Smoking Gun.

- CBS Interactive includes the various CBS news and sports sites, as well as the foodie site CHOW.com, a number of tech news sites (CNET, TechRepublic, ZDNet), ComicVine, a number of gamer sites (Gamespot, Giant Bomb, and the French Gamekult), a number of music sites (last.fm, MP3.com. Radio.com), and sites aimed at the Chinese market (the automobile site xcar.com.cn and the electronic gadget site zol.com.cn).

- Glam Media includes Glam, Ning and all the community sites under its umbrella, Foodie, the family lifestyle site Tend and the men’s lifestyle site Brash.

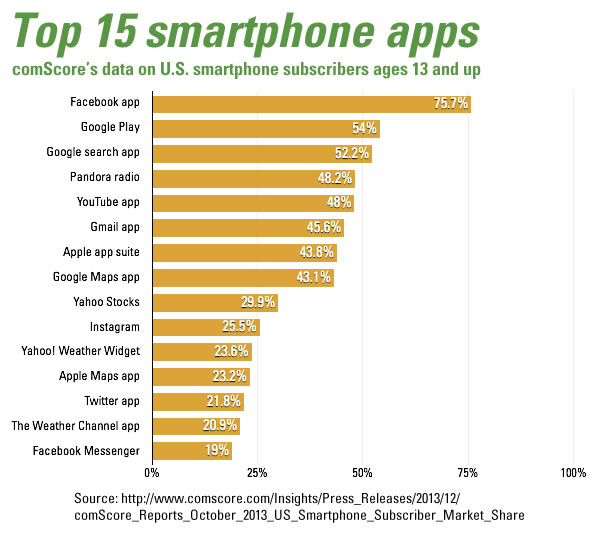

The big players also have the top apps

Click the graph to see the source data.

In the world of apps, there’s a strong presence of mobile platform vendors Google and Apple, and one would-be (and may-yet-be) mobile platform vendor: Facebook. Not only does Facebook have the top app with a commanding 20% lead over the second-place Google Play, they also own two other apps in the top 15: Instagram and Facebook Messenger. Google also has a strong showing with 5 apps in the upper portion of the top 15: Google Play, Google Search, YouTube, GMail, and Google Maps. Apple’s app suite and Maps app occupy two slots in the top 15, and Yahoo! have two apps there: their Stocks and Weather Widget apps.

It’s Apple’s, Samsung’s, and Google’s world, we just live in it

With Apple as the #1 OEM and delivering the #2 mobile platform, Samsung being the #2 OEM and effectively being the Android standard bearer, and Apple and Google have strong showings in both mobile websites and apps, these three companies define the shape of the mobile universe, and the trends seem to indicate that they will continue to do so through 2014. Whether you build apps, accessories, or enterprises on mobile tech, you need to take this into account.

Making longer-term predictions is a riskier game in an industry that was redefined less than a decade ago. Fortunes change in a matter of months, not years, and while the Apple/Samsung/Google troika seem invincible now, think back to the 1990s when Microsoft was the 800-pound gorilla of tech and most startup business plans ended with a statement like “and then we’ll get bought out by Redmond”.

As a final reminder of how quickly and completely this industry can change, here’s Michael DeGusta’s tweet from September, made just after Nokia’s acquisition by Microsoft:

The top 4 smartphone brands of 2006: 1. Nokia: died today. 2. RIM: dead soon. 3. Motorola: dead sooner than you think. 4. Palm: long dead.

— Michael DeGusta (@degusta) September 3, 2013