If you’re looking for a startup job, you’re probably wondering “What warning signs should I look for?”. Fortunately, there’s a recent example to learn from: Fast.

Fast was a startup whose product was Fast Checkout, a one-click checkout system for ecommerce. Every step in the online checkout process increases the chance that the customer won’t complete the purchase. Reducing online purchases to a single click is such a big deal that Amazon patented the process in 1997, which has contributed to its runaway success. The patent expired in 2017, and with that came the competition to own the business of providing one-click checkout to everyone other than Amazon.

In 2021, having raised over $100 million in funding from investors that included Stripe, Fast announced that they were opening their east coast hub here in Tampa to great fanfare:

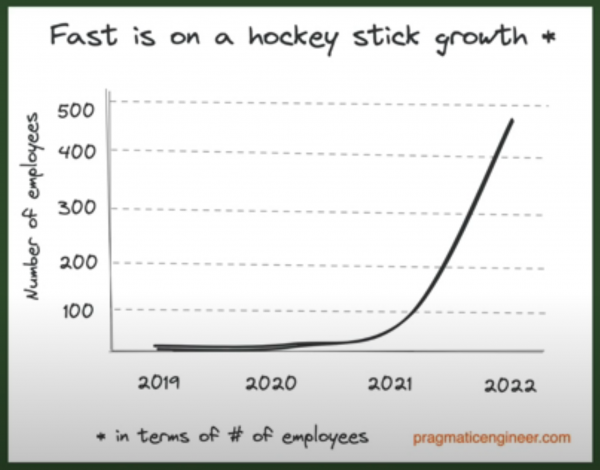

In a collapse that was incredibly (ahem) fast — even for an overhyped company with a burn rate fueled by stunt marketing — they closed down a mere 8 months later.

How do you avoid working at a startup like Fast? There aren’t any hard and (ahem) fast answers, but there are some lessons you can take from its failure and some warning signs you can look out for. Gergely Orosz of Pragmatic Engineer explains in his video, How to (not) choose a startup to join: lessons from Fast:

Big takeaways from the video:

Research the founders.

It’s true: 80% of a startup’s culture is its founder. Look at the founders’ history and be especially watchful for patterns of behavior or signs of the “there’s no there there” syndrome. One of Orosz’ former Uber coworkers tried to convince Orosz to join Fast, but after researching Fast cofounder Domm Holland’s checkered history, he decided to not join.

Ask for numbers.

Ask questions like:

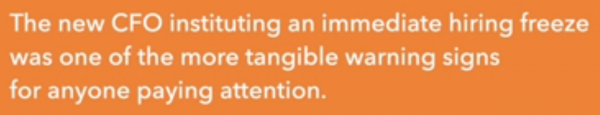

- How much runway do they have? Runway is how long they can stay in operation if their income and expenses stay the same. In an early-stage startup that doesn’t have any customers yet, runway effectively becomes how many months the company can operate before running out of money.

- What’s the burn rate? In the context of startups that raised money in order to get started, a company’s burn rate is the rate that the company is spending that money while it’s not yet making money from its operations. Fast was said to have a burn rate of $10 million per month.

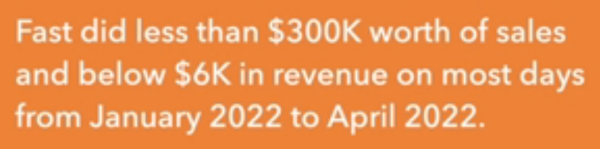

- How much revenue is the company generating? Revenue is the money that the company makes from normal business operations, that is, the money they make from selling either stuff or services to its customers. Fast’s revenue for all of 2021 was about $600,000, which averages to $50,000 a month. Contrast this with their burn rate above.

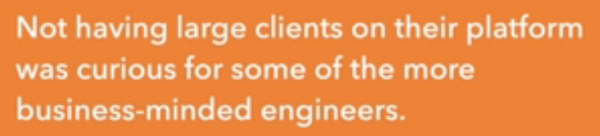

- Find out if there’s a clear set of critical business metrics that they track and if they’re available to you. Any startup worth the effort is painfully and continuously aware of the key metrics that determine whether they’re doing the right things or not. The employees at Fast were unaware of how little revenue the company was making or how few customers they had

Other hints

- Interview your future manager and a founder.

- Talk to investors.

- Talk to people who left.

- Assume your stock grants are worthless.

- Remember that reward is often proportional to risk.

- Watch for worrisome numbers, including…

2 replies on “Warning signs to watch out for before you join that hot new startup”

[…] Hey, Tampa Bay! Did we learn nothing from Fast? Are we so desperate to compete against the Miami, Florida’s so-called “next tech hub,” that we’re willing to glom onto any grifter who comes along and promises to make us the next Silicon Valley? […]

[…] Dom Heller, whose company, Fast, imploded in a year […]