Last Thursday

For the 400 people who got laid off from Okta on Thursday, February 1 — which includes Yours Truly — last Thursday, February 8 at 5:00 p.m. Pacific Standard Time (8:00 p.m. in my time zone, Eastern Standard Time) was the deadline to sign our separation agreement with the company.

A few of us were able to get our separation agreements reviewed by a lawyer specializing in employment law, and the consensus was that the terms were pretty good. I planned to sign it on the final day — but not until later that day. I wanted to do other, more pleasant things first.

Always take the meeting

One of those plesant things was meeting up with Ed Martin, a friend I know from a number of local Meetup groups, particularly the “Lean Coffee” and “Lean Beer” events that the local agile development groups hold. He’d been laid off the previous month, and reached out to me and asked if I’d like to join him for breakfast. He suggested Trip’s Diner, which is a quick bike ride for me, but quite a drive for him.

ℹ️ If you know someone who’s been laid off recently, reach out to them! You might have no idea how important and helpful that kind of gesture is — read this post to find out more.

It may be a cliché, but it’s solid advice that I live by: Always take the meeting. Sure, there are exceptions, but as a general rule, when someone asks to meet with me and my schedule and circumstances allow, I meet with them. With Ed, the decision’s a no-brainer, because I know him as a person and for doing good work. But I’ve also taken meetings with people I knew little about, and more often than not, the meeting turned out to be enlightening, beneficial, and rewarding — and on more than one occasion, I got a new friend.

Ed and I talked about some ideas, including plans to retool the Tampa Bay Apple Coders Meetup to expand beyond just Swift/iOS programming (I’d been getting only a handful of attendees recently), potential Meetup presentations, and maybe even recording some videos together.

I also tried Trip’s Breakfast Cuban sandwich for the first time and was impressed. Where has this been all my life?

💡 Always take the meeting.

Engage the body, engage the mind

After breakfast, I went for my daily bike ride around the neighborhood, which is also how I do most of the groceries. Since I no longer had any pressing meetings or deadlines, I made it a ten-mile ride instead of my usual ten kilometers (about 6.2 miles).

The combination of the breakfast meeting and extended bike ride must’ve jostled a few extra brain cells, because I came up with an idea, which later turned into a Zoom call, which turned into the classified Tuesday meeting I mentioned in my last post.

💡 Make daily exercise part of your layoff routine — and when you get back to work, make it part of your work routine.

Docusigning my life away

At around 4:30 p.m., I decided that it was time to “sign” the severance agreement — or more accurately, I clicked a couple of items on a Docusign document. It’s probably the best severance agreement I’ve ever signed, but that’s cold comfort.

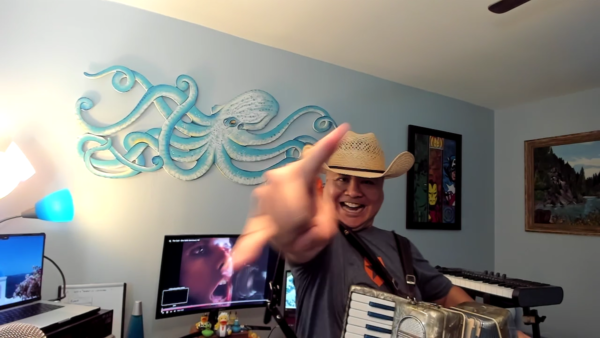

Then I did what I sometimes do after doing something unpleasant and stressful: I grabbed an instrument and played some music. With my small “beater” accordion strapped on, I put on The Cult’s She Sells Sanctuary and played along (it’s only three chords: D, C, and G) at maximum volume.

(Yup, I recorded it too. It’s going into a future video.)

And now, I’ll talk about money and other goodies when it comes to separation agreements.

Money, money, money (and other goodies)

A separation agreement may entitle you to some of the following:

- Severance payment

- PTO payment

- Health insurance [US-specific]

- Outplacement services

See what’s in your severance package, and make note of how much payment you’ll get — that, plus whatever you have in the bank (and if you’re lucky, whatever your spouse/partner brings in) is what you’ll be living on.

Severance

If you’re new to the workforce, you might not be familiar with the concept of a severance package. It’s money and/or benefits that your now ex-employer might give you when they fire you or lay you off. Your now ex-employer offers the severance package (or “severance” for short) which comes with a contract. If you agree to the terms in the contract, you sign it and collect the severance. If not, you walk away without the severance.

From an employer’s point of view, they’re doing you a favor by offering severance. Nowhere in the Fair Labor Standards Act does it say an employer has to pay severance to fired or laid-off employees. It’s like tipping: a generally-expected, but not legally required action, and you look bad if you don’t do it.

It’s supposed to help you get by while you look for your next job, and the amount often depends on how long you’ve worked for the company. I’ve seen severance payments equivalent to one week’s worth of pay for each year the employee has been at the company; some people have been lucky enough to get two weeks’ worth for each year. Remember that severance is income, and subject to income tax. If you get it all at once, it might put you in a higher tax bracket — see if you can get it in installments.

If you’ve been laid off, get the details about your severance package ASAP. Your severance package, plus whatever money you have in the bank, will determine how much “runway” you have.

Now that I’ve given you the cold, rational explanation of what severance is, allow me to provide a hotter perspective…

“A severance package is blood money.”

Creative Commons — click to see the source.

Ethan Evans, a retired Amazon VP, wrote the best, harshest summary of severance that I’ve ever seen. Here it is, lifted straight off a LinkedIn post he wrote last week:

The second time I was laid off, my severance package paid our rent while I hunted for a job in the terrible economy of 2003. Almost all companies offer a severance package when they perform a layoff, but what you may not know is that they are negotiable.

Companies offer a severance package to try to avoid getting sued. The essence of a package is a bribe to sign a bunch of documents that control your behavior after you leave. The company knows they have a lot of leverage at this point, because they just took away your job, and thus your paycheck. They know that for most people an offer of money in exchange for some signatures will be a good deal.

Often what you are being asked to sign does not matter much. A reminder to honor your confidentiality agreement for example, and if you have one, a non-solicitation (don’t poach talent or clients) agreement.

They will also ask you to give up any right to sue them over being laid off. And again, for most people, this is a reasonable thing to do. Unless you have really strong grounds, you will rarely get much in a lawsuit over a layoff.

But, the important part is that HR has a job, which is to get you to sign. What they offer you is their initial offer.

If you ask for more, you can probably get more.

If you give them a plausible reason to give you more, you can likely raise the offer.

Reasons like having just relocated, or being on a visa, or basically anything that makes them feel like bad people for having fired you.

You see, a severance package is blood money. It is a cash apology for screwing you over. It is a way for both the people and the company to tell themselves that they “did right” by you.

So if you can up their sense of guilt, the sense that you in particular were harmed and vulnerable, they will generally up the offer.

To the HR person or the manager, giving you another month of pay and healthcare doesn’t come out of their pockets. They can buy down their guilt and your anger or tears with someone else’s dollars. That is an emotional deal for them to make with themselves. So they can sleep easily at night that they “did the right thing.”

If you’re feeling hesitant about negotiating your severance payment, read the passage above a couple of times.

PTO payment

You may or may not get payment for unused paid time off (vacation time and sick days). If you’re in the US, see if your state requires payment for leftover PTO days.

Health insurance [US-specific]

Since you no longer have an employer, you no longer have employer-provided health insurance. That’s where COBRA — the Consolidate OmniBus Reconciliation Act (you know some policy wonk spent a lot of time and brain cells coming up with that acronym) — comes in. It lets you continue your employer-provided healthcare for 18 or 36 months after you lose your job, depending on the circumstances.

Outplacement services

Many companies, because doing so makes for nice optics, will cover the costs of career counseling/coaching, resume-writing assistance, and other services of this ilk. This is a nicety, but it can be helpful.

Extending your runway

Click to see the source.

You may be out of work for a while, which means you’ll be out of income for a while. One of your assignments will be to stretch your dollar.

Save your home (homeowner’s version)

If you’re a homeowner and your layoff puts you in danger of missing a mortgage payment, you have a couple of options.

Mortgage forbearance is a short-term solution. It’s an agreement that you make with your lender to temporarily make smaller monthly mortgage payments or suspend those payments entirely. It’s not a discount or a freebie! You still have to pay what you owe, including accrued interest, but you’ll avoid missing a payment and the associated late fees, and more importantly, your lender won’t foreclose on your home.

Loan modification is a long-term solution. Like forbearance, it’s an agreement that you make with your lender, but the agreement is to do something like lowering the interest rate or extending the term of the loan.

ℹ️ For more, see the Nerdwallet article What to Do If You Can’t Pay Your Mortgage.

Save your home (renter’s version)

If you’re a renter and your layoff puts you in danger of missing a rent payment, let your landlord know — in writing. You’ll need to come up with an agreement with them to temporarily reduce the amount you’re paying, such as:

- Making smaller payments each month

- Deferring payment (but not for long)

- Covering rent with your security deposit

ℹ️ For more, see the Apartmentguide article How to Talk to Your Property Manager if You Get Laid Off. It’s from April 2020 — about a month into the pandemic lockdowns — but its advice still applies.

General spending

Look at your monthly spending and see where you can reduce it:

- Look at your credit card statements for the last six months and find out what your monthly average is.

- Look at the items on those statements — which are essential, and which are discretionary? What can you cut or at least reduce?

- Look again for subscriptions and subscription services, keeping in mind that you may be paying for things on autopilot that you’ve completely forgotten about or are ignoring (gym memberships are a notable culprit). You should be able to find things you can cancel.

- Stop (or at least cut back on) eating out or ordering in.

Find all the people or organizations that bill you regularly and negotiate with them:

- Call your credit card companies and ask if you’re eligible for a lower rate.

- Call your cable, phone, and internet providers and ask to speak to the cancellation team — say you’ll cancel or switch to a competitor if they can’t offer a better rate.

Investments

[US-specific] You have four options with your 401(k):

- You can leave it where it is. You can’t make any more contributions to it, and you might pay higher fees because you’re no longer an employee.

- You can eventually roll it into your next employer’s 401(k) plan.

- You can also roll it into an IRA (Individual Retirement Account). If you roll it into a Roth IRA, you’ll owe taxes on the amount; if you roll it into a traditional IRA, you’ll pay those taxes later.

- You could also cash it out — but unless your financial situation is dire, do not do this.

If they’re worth it — and you can afford to do so — exercise your vested stock options. Forget any unvested options; they disappeared the moment your job ended. As for the vested ones, the clock is ticking — you’ll have a limited time (typically 30 – 90 days) in which to exercise them. Once that period’s gone, so is your opportunity to exercise.