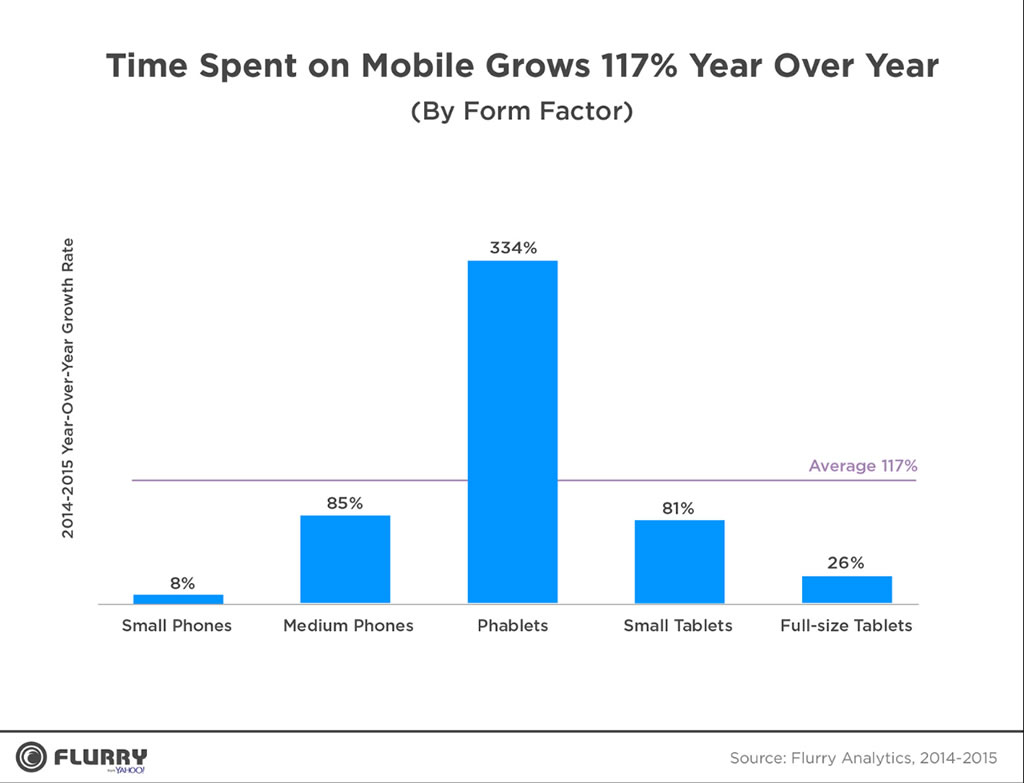

We’re in the phablet era now

Click the graph to see it at full size.

Venture capitalist Fred Wilson looked at research firm Flurry’s State of Mobile 2015 report and took note of the chart above, which shows that the greatest growth in time spent on mobile came from “phablets” — those large phones that blur the line between phone and tablet — and wrote:

There’s not a lot new in this data to be honest, but it confirms a lot of what everyone believes is happening. We are converging on a single device format in mobile and that’s driving some important changes in usage. We are in the phablet era.

Everything I needed to know about good user experience I learned while working in restaurants

At the Neilsen/Norman Group’s blog, Everything I Needed to Know About Good User Experience I Learned While Working in Restaurants lists the many things that you can learn from restaurants and apply to your applications, from designing for both new and expert users to interaction design and error handling to community management.

If you’re not familiar with the Nielsen/Norman Group, they’re the “Monsters of Rock” of user interface and experience. Their principals are:

- Jakob Nielsen, who’s probably best know for literally writing the book on web usability,

- Donald Norman, who’s written a number of great books on usable designs, most notably The Design of Everyday Things, and

- Bruce Toganazzini, who’s done all sorts of UI work, starting with founding Apple’s Human Interface Group (which in my opinion needs to review its priorities).

The cautionary lessons of Evernote’s “5% problem”

Evernote used to be my go-to note-taking app in 2011. I worked across platforms, and I loved that I could start a note on my laptop, continue on my iPad, and then later make tweaks or addenda on my phone. But as time went by, it got buggier and increasingly less usable to the point where I abandoned it worse and buggier until I abandoned it in annoyance.

Their note-taking app got buggier as the company tried to expand so that they had offerings that would appeal to as many people as possible. Therein lay their problem: as their own former CEO put it, people at Evernote conferences would go up to him and say that they loved the platform, but used only 5% of what it could do. The problem was that there was a different 5% for every person. They spread themselves too thin, lost their focus, started half-assign their product lines, and in an attempt to please everyone, ended up annoying them.

Keep calm and carry on developing Android apps

You may have heard that the ongoing legal battle between Oracle (who own Java) and Google (who own Android, which is Java-based) has led to Google’s decision to move from their proprietary version of the JDK to Oracle’s OpenJDK. You may be concerned, but you probably shouldn’t be. It may cause headaches for Google and Android mobile phone vendors, but as Android developers, it shouldn’t really affect you.

As Android developer and online tutor Tim Buchalka puts it:

We write our code accessing the same libraries, and things just work. Of course its going to be a decent chunk of work for Google to get this all working so that we dont have to worry about it, but if anyone has the resources to do it, Google do.

…

What do you need to do as an Android developer? Absolutely nothing, its business as normal! You dont need to change anything in your development process and it may well be that when Android N arrives you won’t have to either. So fire up Android Studio, and get back to coding!

A story you might not know about Microsoft Solitaire: it was created by a summer intern!

Is Wes Cherry a bit annoyed that he never got paid to write one of the most-used applications of the Windows 3.x/9x days? He once answered “Yeah, especially since you are all probably paid to play it!”