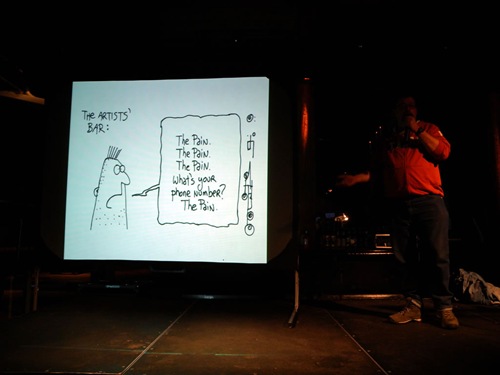

The second-last speaker at yesterday’s Startup Empire conference was Hugh MacLeod, whom most of us know for his comics drawn on the back of business cards and his blog, Gaping Void. Here are my notes from his presentation:

The second-last speaker at yesterday’s Startup Empire conference was Hugh MacLeod, whom most of us know for his comics drawn on the back of business cards and his blog, Gaping Void. Here are my notes from his presentation:

Intro

- It’s easy for an advertising career to tank, especially if you live in New York and drink too much

- I started drawing comics at bars, on the paper that just happened to conveniently be around: the backs of business cards

- I’m not in the VC business, nor am I in the tech business

- I’m greedy — who here’s greedy? [Many hands go up]

- What really drives us? The "C" word: creativity

- The reason we work in this field is that we want to build stuff — fun stuff

- If it pays the bills, so much the better

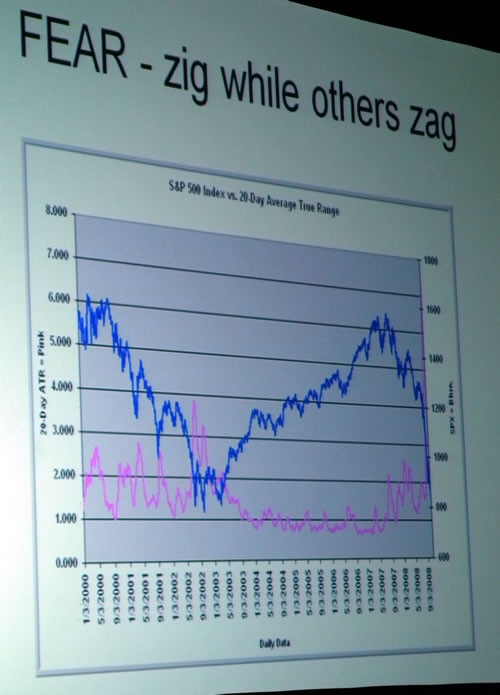

- The "we’re so fucked" thing is pretty long term

- What will get us out of the hole? Creativity. People like yourself, doing and building cool things

- I’m in my 40s — what motivates me now is seeing bright ambitious kids coming out of the colleges

- When I was a kid, there was no internet — not even computers! I had to write my term papers on typewriters

- I want to talk about creativity to the young

- I now present 12 little tips for you people just getting started

1. Ignore everybody.

- When you come up with a really great idea and show it, people won’t get it

- You yourself might not even get it

- Imagine the early days of search: “Why would you want to do that?”

- “Good ideas have lonely childhoods”

- If you’ve had a good idea, you were probably called a fruitcake at the start

- Good ideas alter power balances in relationships, which is why many people resist them

- Your boss doesn’t want you to have a good idea that makes you richer than him

- Good ideas will meet resistance – not because of the idea, but because of power and hierarchy

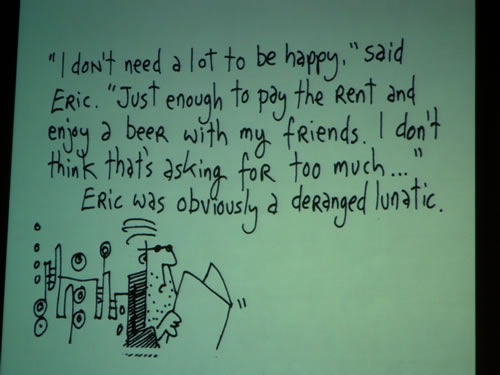

2. The idea you have doesn’t have to be that big.

- Jewish proverb: “A rich man is one who can satisfy his wants”

- I grew up on TV, watching shows about people who had more than us

- Fast-forward 20 years later, I get to do what I want every day:

- Haven’t had to set my alarm clock in years

- Just me and a couple of pens

- And yeah, I read Fast Company, BusinessWeek — “business porn magazines” – they feed greed

- Anyone seen No Country for Old Men? I live in that town!

- One of the locals is Harry, the master brewer, who moved out there and opened his own bar. He makes $500 a day and is the best businessman I know. He does what he wants and everything he does has some meaning to him.

- Meaning scales!

- We owe it to the generations to come to find meaning

3. Put the hours in.

- Nothing happens overnight

- People look at what I do "Aren’t you worried about people ripping you off?" or taking my idea and doing the same thing

- My response: "I’ve already done 10000 cartoons and 7 years blogging"

- Inertia stops a lot of people. Know anyone in a dead-end job? Ever been in one? They say "One day, I’m going to open that cheese shop. But right now, I have to write a report…"

- I have a book coming up. Didn’t quit my job to write it; just woke up an hour earlier every day to write it and posted it on my blog. Penguin eventually contacted me. All I did was put the hours in.

4. If your business plan relies on you being discovered by a big-shot, you will fail.

- I once got a book contract offer. The terms in the contract were terrible and I turned it down

- The publisher, it turned out, was in the business of finding people so desperate to have their moment in the spotlight that they would sign anything

- We now live in an era of cheap, easy, global media — we don’t need middlemen

- I’m friends with Rick Segal…but probably because I don’t need venture capital!

- Where I live in Texas, you can live really cheaply. Part of this is because you run out of things to spend on

- When I hear about people talking about VCs, I think of people looking to have their sorry asses saved

- Don’t get me wrong: it’s great to have VC, but it’s even easier when you get one because you don’t really need one

- "If you’re looking for advice, ask for money; if you’re looking for money, ask for advice.”

5. Do it anyway.

- You don’t know that your idea is the right one at the right time – no one does!

- Do it anyway — that’s how great ideas start out

- Seco0nd-rate ideas are all about the immediate "yes!" response because it keeps them alive longer

6. Everybody is born creative.

- “Everybody gets a box of crayons when they’re young .”

- We turn adolescent and for many of us, somehoe, “our colour gets turned off”

- Suddenly, it’s not about coloring anymore, but concerns like “Got to get a 3.5 GPA, got to get that job…”

- Then you get an idea that you can’t turn off

- It makes you start avoiding your poker buddies

- Most people get scared off by that idea. Doubt creeps in: "What if I get a bad publisher? What if nobody likes my idea?"

- That’s not your idea, that’s your grown up boring self fighting that idea

- Your idea came to you because your soul needs it

- If you don’t nurture that idea, it dies. It also takes a lot of you with it.

7. The “Sex and Cash” theory.

- If you have a creative life and you make money doing it: you generally bounce between two kinds of jobs:

- The sexy creative job

- The one that pays the bills

- In movie stars’ cases, that means alternating between parts in popular hit movies and critically-acclaimed art films

- For a photographer, that means alternating between doing work for indie art mages and paying the bills with photo shoots for catalogs

- Consider Martin Amis: he writes critically acclaimed novels and supplements his income by teaching courses and writing newspaper and magazine articles

- As for me: I do comics on the back of business cards, and I do work for Microsoft and Dell

- It’s a balance of artistic sovereignty and making a living

- “The moment you accept this is when you take off .”

8. Remain frugal.

- This particular lesson took me the longest to learn

- Living in New York City, I was in the top income bracket, for all the good it did. I had so much outgoing cash in rent and other expenses.

- You can live like a king where I do, in Alpine, Texas quite cheaply

- I now have “West Texas expenses, New York wages”

- This is hard to do if you want to be seen in “all the right places”

- Remember: we become creatives because we want freedom, and that includes freedom from avarice

9. I’m going to skip this one.

- It’s too corny!

- [He capitulated later; see the end of this article.]

10. The more talented somebody is, the less they need props.

- At any advertising agency, it’s always the second-rate art director who’s the first to get the newest model Mac

- If you go to any magazine office, it’s the second-rate writer keeps an old Remington typewriter on display

- You see this at startups too: the loft office in the hip neighbourhood with the foosball table

- Remember: the Gettyburg address was written on borrowed stationery!

- We use props to hide behind or mask our inadequacies

- I know a woman who recently IPO’d — she didn’t start in a fancy office, but on her dining room table

- It’s not the props, it’s the good idea and the effort

11. The best way is not to stand out from the crowd, but avoid the crowd altogether.

- Bartenders are the great social enablers of New York City

- No under-50 bartender is really a bartender: they’re actors, musicians, whatever

- They have plan to become famous photographers, musicians, whatever

- The thing about the arts to me: what often drives people isn’t just the money or business, but the prestige: “I want to be like that guy, because he’s really privileged”.

- Ever noticed how few really good writers have blogs? You don’t see literature, you see shit like what I write

- A lot of authors are enamored of books and the prestige attached to them

- The worst thing you can do as a creative is fall in love with a privilege model

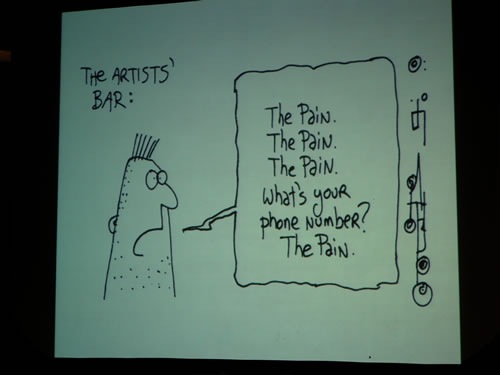

12. If you can accept the pain, it cannot hurt you.

- When my sister was born and my mom was in labour, the pain was unbearable — "Why is this happening to me?" she asked

- The midwife replied: "You’re giving birth to a baby. It’s supposed to be painful."

- Mom accepted that and got on with the birth

- Trying to do something worthwhile and creative is really hard

- As you get older, you realize that pain is part of the process

9. Okay, here’s point number 9, since you asked: We will fail, but we will be forgiven.

- Failure is part of the process

- The important thing really isn’t about reaching the summit, but setting out for it.